The High Cost of Healthcare for Families with a Stay-at-Home Mom or Dad

Healthcare costs a lot even when you have insurance, especially for families

When I interviewed homemakers for a working paper recently published with American Compass, the topic that came up most frequently was the high cost of health insurance.

This isn’t surprising. Most Americans—including most Americans with health insurance—worry about healthcare costs. One 2022 report found that 47% of U.S. adults who had health insurance said it was still “very/somewhat difficult” to pay for healthcare.

Families with one breadwinner and one homemaker face some unique challenges in paying for healthcare. When families decide mom or dad should stay home with the kids, there can be two major healthcare headaches: (1) the way employers pay for family healthcare, and (2) the so-called “Family Glitch,” which impacts subsidies for insurance purchased on the ACA exchanges.

Employer Healthcare

Most families who have a homemaker get their insurance through the breadwinner’s employer. Employers often subsidize family health insurance very differently than health insurance for individual employees. Specifically, employers usually make their employees pay a larger percentage of premium costs for family coverage than for individual coverage.

For example, say Anna works for a small manufacturer that makes specialized ball bearings (a very important job, especially these days…as I learned when I recently tried to replace our dishwasher).

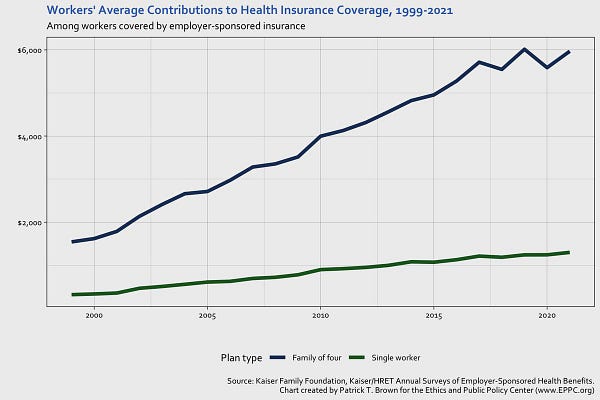

If Anna is single, she will pay (on average) about 17% of the premium costs, at $1,300/year. But if Anna is married, and her husband stays home with their three kids, she will need to get family healthcare through her employer. On average, she will pay about 28% of the premium cost, or around $6,000/year. Obviously, that is a huge difference in cost. Anna’s employer makes Anna pick up a larger percentage of the tab for family insurance than she would if she were single. Patrick Brown at EPPC has a very nice graph displaying this trend year-over-year:

The Family Glitch

The other major problem facing families with a stay-at-home mom or dad is the “Family Glitch.” The problem is technical, but it boils down to a quirk of how ACA subsidies are designed. Let’s go back to our example of Anna. If Anna spends more than 10% of her income on paying for her own health insurance through her employer, she receives an ACA subsidy. But this subsidy only looks at the cost to Anna for her own insurance. It doesn’t take into account the cost of buying family insurance.

The Tradeoffs podcast has an absolutely fantastic episode about a couple who got divorced because of the Family Glitch. The episode description:

The scene seems straight out of a movie: A young couple stands solemnly before the judge. They’ve been married just a year, and they’re here – for the second time – to ask for a divorce.

A month ago, the same judge gave them a hard time, then said no. He still thinks there is something fishy about their request.

And he’s right. The young people want to be together. But the only way they can afford that is to legally split up.

It isn’t about love. It’s not about employment or family pressure. It’s about health care.

Liana Wolk and Owen Marshall are caught in an Affordable Care Act loophole.

I strongly suggest you give it a listen, if you are interested or impacted by these issues. The Biden Administration has proposed a fix…but it’s likely to face legal challenges, and could be reversed by subsequent administrations.

If you are a mom or dad considering staying home, or a family with a homemaker parent, the cost of healthcare should be at the top of your list of concerns when deciding the future. I’d argue that for businesses and policymakers, this issue should also be of significant concern…for reasons I’ll discuss in future posts!